Service

Franchise in Vietnam

How to Successfully Launch a Franchise in Vietnam

Discover the potential of franchising in Vietnam. Explore the opportunities and benefits of starting a franchise in this thriving market.

Did you know foreign franchises can expand into Vietnam’s increasingly strong consumer market? With the right approach, this can be a strategic approach to build a strong presence in this dynamic market.

However, setting up a franchise in Vietnam requires careful navigation of local regulations. This guide outlines key legal requirements and practical steps to help you confidently establish and grow your franchise.

Regulatory Framework for Operating a Franchise in Vietnam

Before launching a franchise in Vietnam, you must comply with the country’s legal framework, which governs registration, contracts, and operational requirements.

Key Requirements for Opening Foreign Franchises in Vietnam

Pre-requisites and Required Documents for Franchising in Vietnam

To establish a franchise in Vietnam, you must meet certain prerequisites. Failing to comply with these regulations can lead to severe penalties, forced suspension of operations, and potential legal disputes that could jeopardize your business:

• The franchise system must have been operational for at least one year

• For sub-franchising, the master franchise must be operational in Vietnam for at least one year

• The brand and products/services offered must not be on the government’s prohibited list

Additionally, as part of the registration process, you will need to have the following documents on hand:

• Franchise Registration Application

• Power of Attorney

• Franchise Agreement

• Previous Year’s Audited Reports

• Brief introduction of the franchisor

• Business Certificate

• Trademark or Copyright Certificates

• Approval from the primary franchisor (for sub-franchising)

Franchise Agreement Between the Franchisee and the Franchisor

A strong franchise agreement is the backbone of a successful franchise in Vietnam. It defines the rights and responsibilities of both the franchisor and franchisee, ensuring smooth operations, brand consistency, and legal protection. A well-crafted agreement not only safeguards your business but also strengthens your partnership with franchisees.

To comply with Vietnamese regulations, your franchise agreement must be written in Vietnamese and include the following details:

• Franchising fees, royalties, and payment methods

• Intellectual property rights

• Operational guidelines

• Duration of franchising

• Dispute resolution procedures

• Renewal and termination clauses

Setting Up A Foreign-Owned Business Franchise in Vietnam

How to Set Up A Foreign-Owned Franchise

There are three ways you can enter the Vietnamese market, each offering its advantages and requirements based on your business activities or needs. The right approach depends on factors such as operational control, investment capacity, and regulatory considerations:

• Franchising From Abroad Without A Local Entity: This allows you to enter the Vietnamese market without establishing a physical presence in the country. It requires a local partner to set up the franchise and handle any subcontracts.

• Acquiring A Local Company: The company must be operating for at least one year. It may require extra due diligence to assess the local company’s financial health and legal compliance beforehand.

• Setting Up A Foreign Direct Investment (FDI) Company: A Limited Liability Company is the most common option for this. However, it requires an approval letter from the People’s Committee where you are setting up the franchise. Plus, you must obtain an Investment Registration Certificate (IRC) and Enterprise Registration Certificate (ERC).

Legal Responsibilities of A Franchise Owner

Once your franchise is established in Vietnam, staying compliant with local regulations is essential for smooth operations. As a franchise owner, you must meet both franchisor standards and government requirements. Key legal obligations include the following:

• Compliance with Franchise Agreement: Adhere to operational standards and guidelines set by the franchisor. Pay franchise fees, royalties, and other required payments on time.

• Employment Law Obligations: Ensure fair treatment of employees and maintain accurate payroll records.

• Financial and Reporting Obligations: Maintain accurate financial records and submit timely financial reports to the franchisor as required. Pay taxes and comply with tax regulations while adhering to accounting standards and practices.

• Legal and Regulatory Compliance: Obtain necessary licenses and permits for the business and comply with industry-specific regulations.

• Intellectual Property Protection: Use the franchisor’s trademarks, logos, and other intellectual property as specified in the agreement while protecting confidential information and trade secrets.

• Marketing and Advertising: Participate in marketing initiatives as required by the franchisor and adhere to advertising guidelines and standards set by the franchisor.

• Training and Operations: Attend required training sessions provided by the franchisor, implement and maintain operational standards as outlined in the franchise manual, and ensure proper training of employees.

Wholesale and Retail

How to Set Up A Wholesale and Retail Business in Vietnam

Discover the steps to set up a wholesale and retail business in Vietnam. Navigate Vietnamese laws, regulations, and capitalize on the country’s growing consumer market.

Are you thinking of capitalizing on Vietnam’s growing consumer market? In this article, we’ll walk you through the essential steps to successfully establish and operate a wholesale and retail business in Vietnam. We’ll also provide an overview of key requirements for ensuring compliance with Vietnamese laws, and regulations, and provide a detailed step-by-step process.

Overview of the Wholesale and Retail Industry in Vietnam

Vietnam’s wholesale industry is experiencing significant growth, driven by rising consumer demand and an expanding retail market. In 2023, the retail sales of goods in Vietnam reached approximately 4,859 trillion VND, reflecting an 8.6% increase from the previous year. This upward trend presents substantial opportunities for businesses to diversify and innovate.

Currently, the most common business structure for a wholesale and retail business in Vietnam is a Limited Liability Company (LLC). An LLC allows 100% foreign ownership and provides liability protection for its members. Furthermore, this business structure provides lower tax rates, increasing profitability for retailers, in addition to low initial set-up costs.

As for the most common business setups for the wholesale and retail industry in Vietnam, the market has a preference for:

- Retail Storefronts (Supermarkets, Department Stores, Specialty Stores)

- E-Commerce Marketplaces

- Dropshipping Businesses (Wholesale Outlets, Distribution Centers)

- Omnichannel Retail (Combination of both online and offline stores)

Key Requirements for Setting Up A Wholesale and Retail Business in Vietnam

Wholesale Business Requirements

In Vietnam, a business is considered wholesale when it sells goods in large quantities to retailers, businesses, or other commercial entities instead of directly to individual consumers. These are generally considered B2B entities. Below are the essential requirements and regulations for establishing a wholesale business:

- Investment Registration Certificate (IRC) from the Department of Planning and Investment

- Enterprise Registration Certificate (ERC) or Business Registration Certificate (BRC) Both these licenses double as sufficient licenses for engaging in wholesale business activities

- Appoint a legal representative

- An official business address

- The proposed capital investment should align with planned expenses and your business activities.

Retail Business Requirements

Retail refers to the sale of goods and services directly to consumers (B2C) for personal use, typically in smaller quantities. The following are the key requirements and regulations for operating a retail business, ensuring compliance with local laws and market standards:

- Investment Registration Certificate (IRC) from the Department of Planning and Investment

- Enterprise Registration Certificate (ERC) or Business Registration Certificate (BRC)

- Retail Sale License from the Department of Industry and Trade (MOIT)

- Business License for retail distribution activities

- Retail Outlet Establishment License (required for each retail outlet location)

- Appoint a legal representative

- A financial plan for running a retail business

- Demonstrate financial capacity and explain funding sources

- No overdue tax liability if established in Vietnam for over a year

- Retail outlet locations must comply with relevant local planning regulations

In addition to these requirements, companies must go through an Economic Needs Test (ENT). The ENT is necessary for retail outlets beyond their first retail store if they are:

- 500sqm or larger

- Not located in a shopping mall

- Not classified as a convenience store or mini supermarket

However, foreign investors from countries within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) are exempt from going through the ENT, making it easier to start their retail business in Vietnam. These countries include Singapore, Australia, Canada, Japan, Malaysia, Chile, and more.

Import Regulations for A Wholesale and Retail Business in Vietnam

Import Requirements for Wholesale and Retail in Vietnam

When importing products into Vietnam, the most important step is obtaining an import license. There are two types of import licenses in the country, depending on your products:

- Automatic Import License: For goods posing minimal risk

- Non-Automatic Import License: For goods that require closer inspection by authorities

For wholesale businesses, the IRC and ERC/BRC are enough, and no trading licenses are necessary for importing products. However, retail businesses will require a Trading License from MOIT which takes around 6 to 12 weeks to process. This Trading License is necessary for imports and distribution activities as it specifies intended retail activities and products.

Product Registration for Regulated Goods in Vietnam

Additionally, certain products require registration with Vietnamese authorities before importation. These include food and beverages, cosmetics, medical devices, and pharmaceuticals. As for import taxes, you should keep the following in mind:

- Import Duty

- Value-Added Tax (VAT)

- Special Consumption Tax (SCT) for certain products

- Environmental Protection Tax (EPT) where applicable

Furthermore, the following documents are required for importing your products into Vietnam:

- Commercial Invoice

- Packing List

- Bill of Lading / Airway Bill

- Certificate of Origin

- IRC and ERC / BRC

- Conformity Certificate (if applicable)

- Inspection Certificate (if applicable)

Steps to Register Wholesale and Retail Business in Vietnam

Registering a wholesale and retail business in Vietnam involves a series of steps that can vary depending on your business structure. The process can differ depending on whether you’re planning a physical retail store or an online retail operation. Below you’ll find the key steps for setting up a wholesale or retail business in Vietnam:

- Establish A Company: Setting up a Limited Liability Company is a crucial first step for setting up a wholesale and retail business in Vietnam. During this process, companies will obtain the IRC and ERC from the Department of Investment and Planning which are essential for operations.

- Open A Company Bank Account: A corporate bank account is necessary to deposit the business’s capital as evidence which is important as part of the requirements during registration.

- Obtain Operational Licenses and Appoint Representative: Operational-specific licenses need to be applied for at the offices of their respective governing bodies and a local representative must be appointed.

- Establish an E-Commerce Platform: Businesses venturing into e-commerce must register with the Ministry of Industry and Trade (MOIT) and obtain an E-Commerce Business License. If the business criteria are met, a representative office must be set up, and e-commerce platforms must comply with the Law on E-Transactions and Law on Protection of Consumer’s Rights.

- Register Products: Certain products will require additional licensing and approvals from local governing bodies. This includes those under the food and beverage, health supplements, and medical device categories.

Setting up an office in Vietnam

How to Set Up an Office in Vietnam

Read through this guide to setting up a business in Vietnam. From company registration to setting up an office and hiring employees.

Before setting up an office in Vietnam, you must understand local regulations and market dynamics. This article will cover everything you need to start an office in Vietnam. This includes the types of legal entities, requirements, and registration process. We will also talk about key locations to start an office in Vietnam, and the employee hiring process.

Legal Framework for Company Registration Process in Vietnam

Registering a legal entity in Vietnam

To set up your office in Vietnam, you must register a legal entity there. There are several types of companies you can start. One of the most common types is a Limited Liability Company (LLC). Depending on the industry, an LLC can allow up to 100% foreign ownership, notably in IT, trading, manufacturing, short-term training centers, and language schools.

There are two types of LLCs you can establish in Vietnam:

- Single-Member LLC – only one member has exclusive rights over decision-making and holds full responsibility for the company’s liabilities.

- Multi-member LLC – can have between 2 to 50 members who share responsibilities depending on their capital contributions. A Member’s Council typically governs these companies with a director managing daily operations.

If your main objective is to establish an extension of your company, you can set up a branch office in Vietnam. A representative office can also act as an extension to your business but is not permitted to generate income and acts only as a liaison office.

IRC and ERC Requirements in Vietnam

Before an office in Vietnam is fully operational, you need to register your business with the Department of Planning and Investment (DPI). Foreign entities are required to obtain an Investment Registration Certificate (IRC) under the Law on Investment (2020). Afterwards, you can obtain an Enterprise Registration Certification (ERC) to legally operate in Vietnam. Here’s what you will need:

Post-registration Compliance

Once you have obtained both the IRC and ERC, you can then undertake the following mandatory steps for your company in Vietnam to complete your office setup:

- Register with the local tax office – Upon receiving the ERC, you must register your company with the General Department of Taxation. This is mandatory for all businesses earning income in Vietnam. The local tax office will issue a company registration code that also serves as a tax code number.

- Open a bank account for business transactions – you will also need to open a corporate bank account in Vietnam which will be used for all business transactions.

- A public announcement about your registration – after registration, companies must make a public announcement regarding their registration on the National Enterprise Registration Portal within 30 days of receiving their ERC.

Other Considerations for Starting an Office in Vietnam

Key Locations for Setting Up an Office in Vietnam

An important aspect of starting an office in Vietnam is deciding where it’s going to be located. Luckily, Vietnam has plenty of locations to start an office, each with unique advantages to choose from based on your specific business model and objectives. Here are popular locations to start a company in Vietnam:

- Ho Chi Minh City (HCMC) – as the largest city in Vietnam, HCMC is the country’s economic powerhouse. HCMC is home to numerous corporate headquarters with a large expatriate community. Ho Chi Minh has diverse economic activities including finance, manufacturing, tourism, and technology.

- Hanoi – the capital city and political center of Vietnam, Hanoi is known for its rich history and cultural significance. It is a major hub for e-business and technology with a focus on high-tech industries. It is also close to important trading routes and neighboring countries.

- Alternative locations in Vietnam:

- Da Nang – a key port city known for its beautiful beaches with excellent transport infrastructure. It’s attractive for businesses who want to minimize operational costs while employing a skilled workforce.

- Hai Phong – another major port city in Northern Vietnam, Hai Phong is crucial for trade and logistics. Its economy is centered on shipbuilding, textiles, and food processing. It’s a strategic location if your company is involved in import-export activities.

- Nha Trang – The growing tourism sector provides opportunities in hospitality and related services.

- Phu Quoc – Rapidly developing infrastructure aimed at enhancing tourism capabilities with opportunities in hospitality, real estate development, and eco-tourism.

Average Cost of Starting a Company in Vietnam

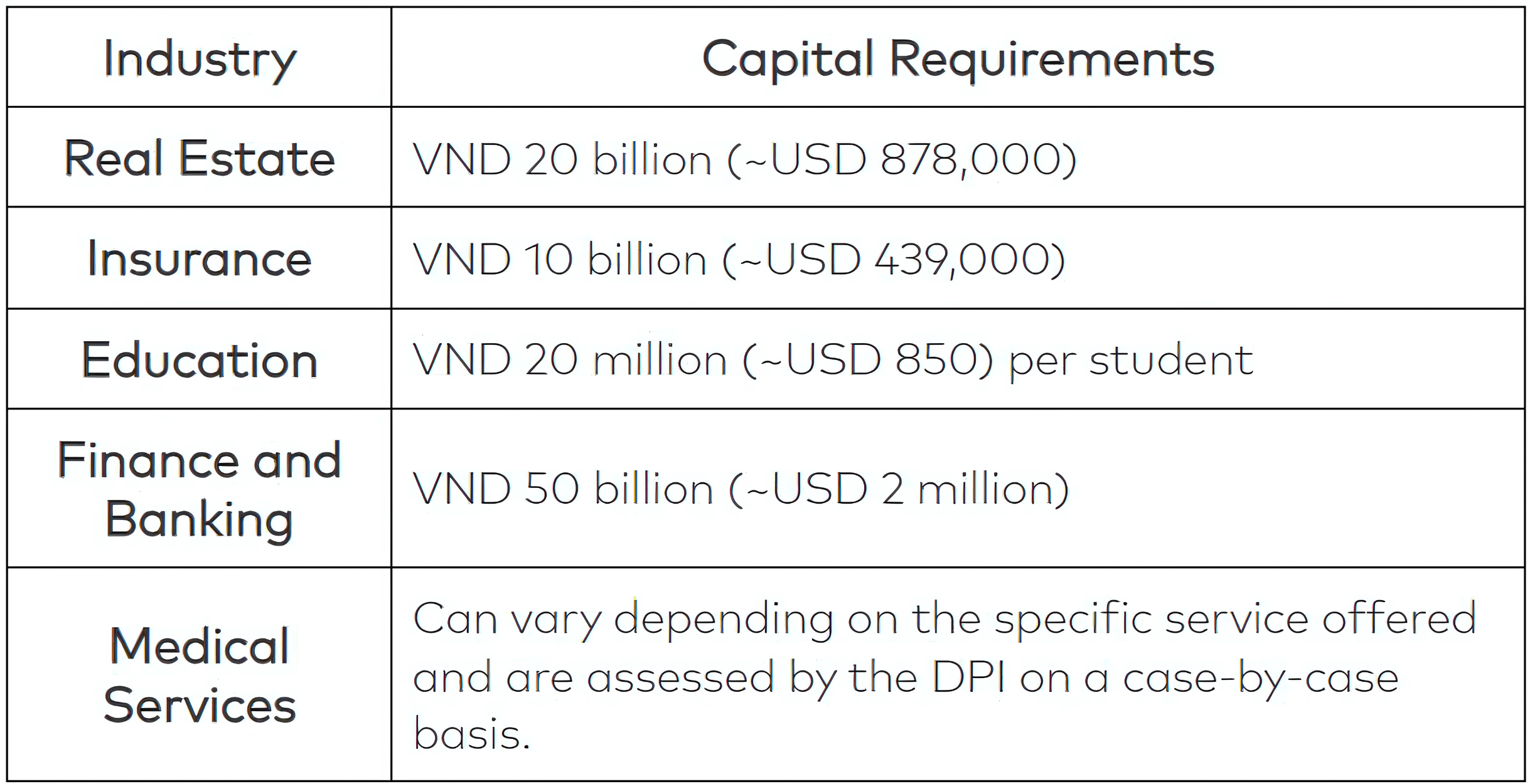

Although there are no minimum requirements for most sectors, the Department of Planning and Investments recommends roughly around ~ USD 10,000 to cover initial expenses. Certain sectors, however, have specific capital requirements due to regulatory standards:

Apart from the capital requirements, you also need to consider office space rental costs. This may vary depending on the region and how much space you will need for your office in Vietnam, as well as the location. The Ministry of Construction in Vietnam rates buildings into three tiers depending on the architecture, infrastructure, and management services of the building. Different regions have different costs for each tier. Here’s how much office space would cost in HCMC and Hanoi:

|

Category |

Ho Chi Minh City |

Hanoi |

|

A |

USD 49.6 to 60 /sqm per month |

USD 32 /sqm per month |

|

B |

USD 25 /sqm per month |

USD 14 /sqm per month |

|

C |

USD 15 to 24 /sqm per month |

USD 12 to 18 /sqm per month |

Hiring Employees in Vietnam

To hire employees in Vietnam, your company must adhere to the country’s Labor Code. This outlines the maximum working hours (maximum of 48), overtime pay (150% to 200% of regular wages), and employee rights to unionize. The Labor Code allows for probation periods of up to two months for managerial positions and one month for other roles.

As a business owner, you are also required to contribute to your employees’ social insurance. This includes health insurance, unemployment insurance, and pension contributions. The total contribution rate is approximately 32% of the employee’s salary (with the employer covering around 21%).

Foreign workers are required to obtain a work permit before commencing employment in Vietnam. To qualify, you must do the following:

- Demonstrate that no qualified Vietnamese candidate is available for the position.

- Submit an application that includes proof of recruitment efforts.

Visa and TRD

How to get a long-term visa and a temporary resident card in Vietnam

Explore long-term visa options in Vietnam and how a Temporary Resident Card (TRC) allows you an extended stay in the country without frequent visa renewals. This guide covers all key requirements and essential considerations for securing the right stay permit in Vietnam.

Thinking of moving to Vietnam? The country offers several long-term visa options, as well as the opportunity to obtain a Temporary Resident Card (TRC) which allows you extended stays without frequent renewals. This guide outlines their key requirements and essential considerations for securing the right stay permit in Vietnam.

Do you need a work visa in Vietnam?

If you plan to work in Vietnam, you’ll need to obtain a work visa (LD visa). This also applies if you set up a company and want to hire foreign nationals. However, this visa alone doesn’t grant you the legal right to work– you will also need a separate work permit. Keep in mind that both the visa and work permit application will have to be sponsored by the employer.

Certain roles, particularly high-level positions such as managers or specialists, may qualify for a work permit exemption. These typically apply to individuals whose expertise is not readily available in Vietnam or those working under international agreements.

Generally, there are two ways for foreign nationals to work in Vietnam:

- As employees: Requires an up to 24-month work visa and work permit.

- As consultants: Requires an up to 12-month business visa without a work permit.

Overview of Long-Term Resident Visa Options in Vietnam

Who is eligible for a Long-Term Visa in Vietnam?

Vietnam offers several different types of long-term residence (LTR) visas. You qualify for a LTR visa in Vietnam if you fall under one of the following categories:

- Employment in Vietnam: You work for a Vietnamese company and require a work visa.

- Investment in Vietnam: You own shares in a company or represent a parent company.

- Family members of expatriates: Spouses, children, and dependents of foreign workers can obtain visas under family sponsorship.

- Long-term visitors or retirees: Some foreigners seek extended stays for retirement or various other personal reasons.

Most common Visa Options for Long-Term Residence in Vietnam

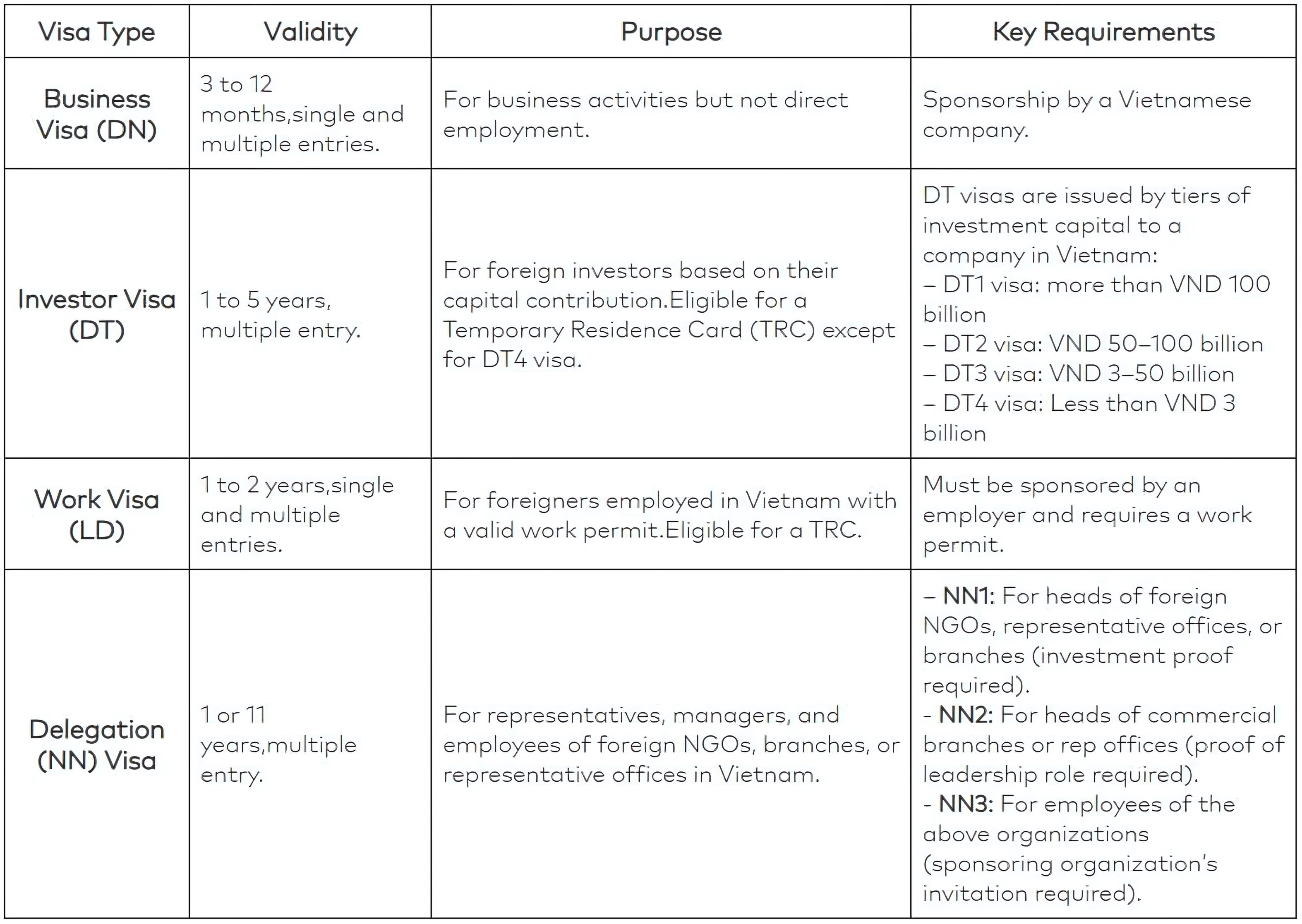

Due to the variety of visa options, it is important that you properly assess whether you meet the requirements for staying under a specific permit, as well as whether it allows you to conduct your intended activities.. Here’s a comparison of the most common options available for long-term residency in Vietnam:

|

Visa Type |

Validity |

Purpose |

Key Requirements |

|

3 to 12 months,single and multiple entries. |

For business activities but not direct employment. |

Sponsorship by a Vietnamese company. |

|

|

1 to 5 years, multiple entry. |

For foreign investors based on their capital contribution.Eligible for a Temporary Residence Card (TRC) except for DT4 visa. |

DT visas are issued by tiers of investment capital to a company in Vietnam: |

|

|

1 to 2 years,single and multiple entries. |

For foreigners employed in Vietnam with a valid work permit.Eligible for a TRC. |

Must be sponsored by an employer and requires a work permit. |

|

|

1 or 11 years,multiple entry. |

For representatives, managers, and employees of foreign NGOs, branches, or representative offices in Vietnam. |

– NN1: For heads of foreign NGOs, representative offices, or branches (investment proof required).- NN2: For heads of commercial branches or rep offices (proof of leadership role required).- NN3: For employees of the above organizations (sponsoring organization’s invitation required). |

5-Year Visa Exemption for Eligible Foreigners

Vietnamese nationals living overseas and their direct family members are eligible for a 5-year visa exemption, allowing multiple entries and extended stays without renewals. To qualify for this exemption, you must fall into one of the following categories:

- A former Vietnamese citizen who now holds foreign nationality.

- A spouse or child (under 18) of a Vietnamese citizen.

How to Obtain a Temporary Resident Card (TRC) in Vietnam

What is a TRC and how is it different from a Long-Term Visa in Vietnam?

A visa grants you permission to enter and stay in Vietnam for a specific period but it requires periodic renewals or extensions to remain valid. These generally involve presenting yourself at a customs office at specific intervals and paying a fee.

A Temporary Resident Card, on the other hand, acts as a residency permit, allowing you to live in Vietnam for an extended period without the hassle of visa renewals. Depending on your eligibility, a TRC can be valid for up to 10 years, making it a more convenient option for long-term stays.

To apply for a TRC, you must first enter Vietnam with an eligible visa– such as a work visa, investor visa, or dependent visa. Once in the country, you can transition to a TRC with an application at the Immigration Department, replacing the need for ongoing visa extensions.

Important:

- Temporary resident cards can only be applied onshore through the Immigration Department.

- The validity of the TRC is also tied to the validity of your passport. It will always expire at least 30 days before your passport’s expiration date. So if your passport has less than 13 months of validity remaining, you will qualify for a shorter TRC instead.

Who is eligible for a temporary resident card in Vietnam?

To be eligible for a temporary resident card, you must hold a work permit that is valid for at least 12 months. Generally, you qualify for one if you:

- Hold an eligible visa– the investor visa (DT1, DT2, or DT3), work visa (LD1 or LD2), or family/dependent visa (TT).

- Are a foreign expert, manager, or executive working in Vietnam with a valid work permit or exemption.

- Are a dependent of a foreign worker or investor (spouses and children).

The table below outlines the visa types and minimum investment amounts that qualify for a TRC and their corresponding validity periods:

|

Maximum Validity |

Visa Type |

Eligibility Criteria |

|

Same duration as the sponsor’s TRC Validity |

Dependent Visa (TT) |

Spouses and children of foreign workers or investors. |

|

10 years |

DT 1 Investor Visa |

Capital contribution of VND 100 billion or more. |

|

5 years |

DT 2 Investor Visa |

Capital contribution from VND 50 billion to VND 100 billion |

|

3 years |

DT 3 Investor Visa |

Capital contribution from VND 3 billion to VND 50 billion |

|

2 years |

LD Work Visa |

Foreign employees with a valid work permit or work exemption. |

If you currently hold a business visa (DN), keep in mind that it does not qualify for a trc. To secure long-term residency, you will need to transition to an eligible visa, such as a work visa (LD) sponsored by your employer or an investor visa (DT) based on your capital contributions.